What is a Sale?

A Sale can be thought of as any time that an item or modifier is saved on the Impos system. The save mechanism in most venues means that a production docket is printed, but this isn’t always the case.

Any time that the ‘Send Order’ button is used; you navigate away from the open transaction by logging out or opening a new tab or table, counts as a save of the existing order.

Items that have been ‘Sold’ don’t have to be paid off in the same period. Think of a restaurant table, where items are ‘Sold’ (i.e. saved to the table and a production docket is sent), however it’s usually not paid off until the end of the dining experience.

If you’re using the POS in an over the counter transaction mode (i.e. everything is placed on a transaction and cashed off there and then), this counts as a sale and a payment. This brings us to our next point.

What is a Payment?

A Payment is any time that a transaction has a payment event recorded against it. This typically occurs by pressing a payment type button on the screen, for instance Cash, Credit, TYRO, Amex, Account etc.

Payments can be thought of in two parts. The value of the items that have been paid off, and the tender type that was used in the payment (ie, cash, Eftpos, etc.).

There are some features that don’t appear in the items that have paid off (in Impos Web reports this is called the “Item Sales Report” with the selection of “Based on Payment”) if you are using this to balance your till. For instance: Payment type surcharges, Tips and Cash in/out. These only appear in your cashier reports, which is the report you should use to balance your till.

What is included in a Sale?

The total value of the items sold follows the equation below:

List Price (inc. GST) + Surcharges – Discounts – Voids – Refunds = Total Values of Sales

You can look at your Gross Sales, which is the total value of all sales at list price OR you can look at Net Sales, which is the actual value of the items that have been sold. This figure is displayed in both the Cashier Report, and in the Web report “Item sales report”

Sales to do not include tips, Cash In/Out, or Payment Surcharges, as these do not determine the value of items sold, they only impact the amount of payments in the cash drawer.

What is included in a Payment:

All items that have a payment event recorded against it count as items that have been paid; i.e. tables that are still open don’t contribute to this report at all.

Items that have been paid off do not include Tips, Cash In/Out, or Payment Surcharges as these do not determine the value of items sold, they only impact the amount of payments in the drawer. These will appear when viewing tender types breakdown, or when viewing the Cashier Report.

What should you be balancing to?

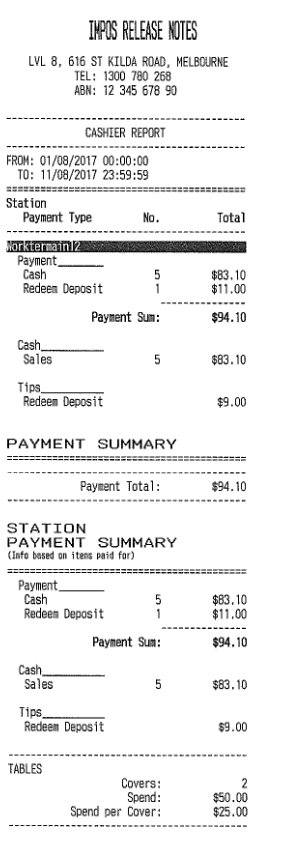

The amount that you should be balancing to is your tender type breakdown, or “Payment Summary” section of the Cashier Report. These breakdowns factor in all post payment adjustments which are cash in/outs, tips and credit card surcharges.

How can I view what is outstanding on the POS?

In the Cashier reports, once you have run a “By Station” report, you’ll also be able to run, view and print, an “Outstanding Details” report. This report will give you a breakdown of each Order, Tab and Table that is not fully paid off.