Seamless Guest Experience

Experience the thrill of the Impos integration with RMS Cloud, empowering POS users to charge orders directly to a guest's account. Each charge contributes to their account balance, ensuring a seamless guest experience within the venue, and eliminating the need for multiple payment methods. Furthermore, with the wealth of data available within RMS, managing finances and accounts becomes a breeze, making your operations smoother than ever.

Use Case

The Reservation

Order Flow

Search

Search By Name

Search By Room

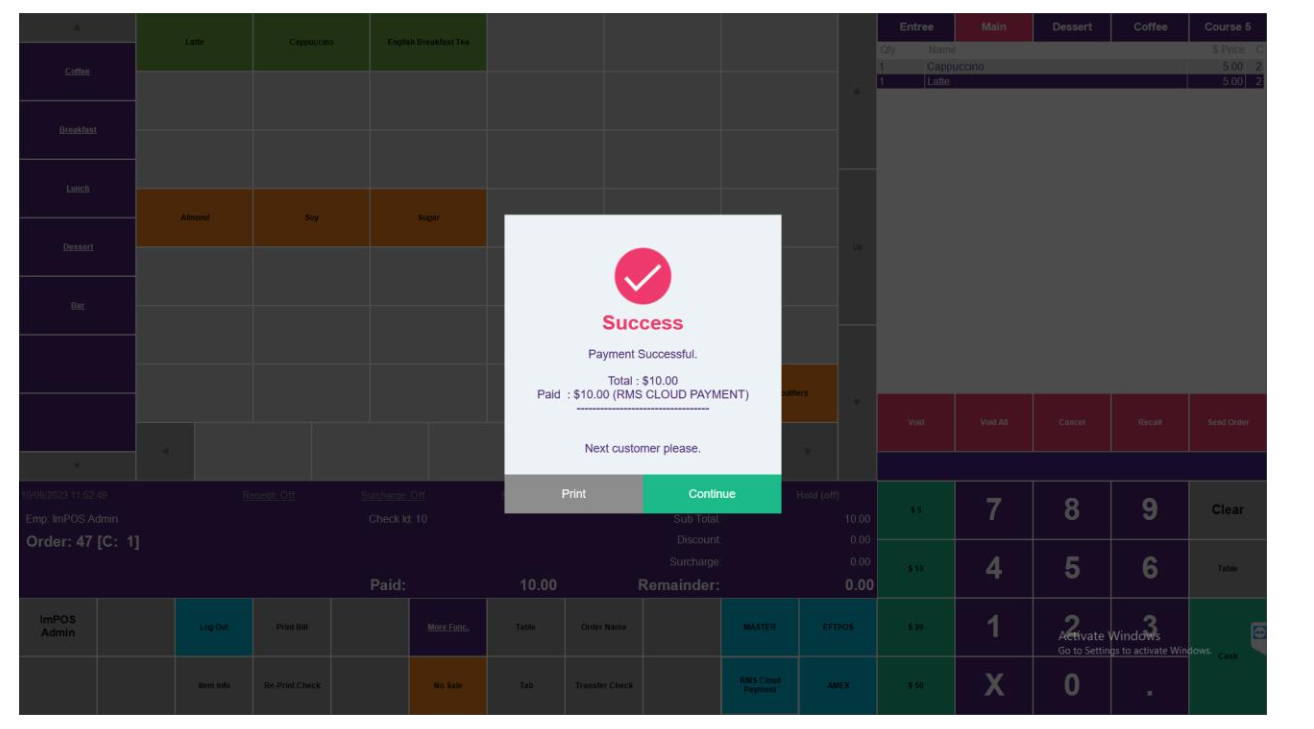

The POS user finalizes the payment by charging it to Jane Doe's reservation account.

Guest checkout

Guest checkout

Jane Doe is now leaving the accommodation and has come to reception to checkout. The guest’s account is highlighted in RED, indicating an outstanding balance. The check-out will also warn of this.

The receptionist checks Jane Doe’s account balance.

Jane Doe settles her outstanding balance by making a cash payment.

The receptionist completes the check-out process for Jane Doe.

Guest Reporting

At the end of the day, the hotel manager reviews the spending reports to assess the charges and their corresponding locations. The manager specifically checks the Daily Charge report, which reveals a $10 charge attributed to the 'Restaurant Food' account (GL code 4-2200). This information provides insight into the spending patterns and helps track revenue sources within the establishment.

To obtain a detailed breakdown of charges associated with GL code 4-2200, the manager refers to the Sundry Usage report. This report provides a comprehensive overview of the specific expenses and transactions linked to that particular GL code, enabling the manager to analyze and track the usage of funds allocated to 'Restaurant Food'.

Configuring charge account distribution and property

Currently, in Impos, charges can be mapped to a single account throughout the entire property. This means that all charges, whether from the restaurant or bar, will be reconciled to the same GL code. However, in the future, there may be an option to specify sundry charges on a per-terminal or area basis. To configure this feature, administrators and financial controllers need to set up a GL code and its corresponding sundry in the RMS portal. This setup allows for more granular tracking and reporting of charges based on specific terminals or areas within the property.

To allocate charges to the specified sundry, the configuration needs to be done in Impos Back Office. Additionally, a Property ID must be set, which corresponds to the property where the POS system is being used. Both the sundry configuration and the Property ID should be provided by the RMS Cloud property administrator to the Impos integration team or the venue manager responsible for the POS operation. This ensures that charges are accurately allocated and reconciled within the system

Requirements

Impos 6.58+

To initiate the integration process with Impos Solutions, the customer should send a request to their sales contact at RMS Cloud. The email address for sales inquiries is sales@rmscloud.com.

RMS charges a monthly fee for any POS integration.

Once the integration is provisioned, the customer will receive a Client ID and Client Secret, which are required for configuring the integration.

We will also need to request a Sundry ID from the customer, which they can configure in their system. All charges will be mapped to this sundry for reporting.